People ask every now and then why Florence‘s rates can seem a bit higher than expected.

We understand, and it’s natural to look for savings where you can, especially in times like these.

But, there’s a bigger picture to consider when we talk about what these numbers really mean.

Ahead of the national minimum wage increase on April 1st 2024, we delve into exactly how our rates are priced to uphold quality care – and why agencies boasting lower rates often can’t say the same.

The true cost of care

We’ve seen some shocking headlines recently, haven’t we?

Over 500 organisations (including a major healthcare staffing agency) were caught not giving their staff the bare minimum.

And that’s not just a numbers issue – it’s a human issue.

Florence’s rates aren’t just about fair pay; they’re about respect, about the quality of care that reaches those who need it, and about holding up the high standards we set in our sector.

When we choose to stand by fair rates, we’re choosing to invest in a system that values people – from the carers to the cared for. It’s about doing right by everyone, closing the door on the unscrupulous practices that have no place in our field.

It’s not just about compliance; it’s about compassion and the collective commitment to uphold the dignity and welfare of our workforce and those they support.

So, while our rates may appear steeper than some at first glance, they’re a testament to our commitment to quality, legality, and the ethical treatment of our employees. We hope that’s what you want to invest in too.

In the long run, our rates ensure the sustainability and excellence of the care we provide, making sure everyone, from your staff to the people you care for, are looked after the way they deserve.

As we’ve explored before, sadly, not all staffing agencies share this commitment.

Some bad agencies are illegally under-paying staff, evading tax and cutting essential team investment.

Here are five red flags to tell if your agency is one of them.

Red flag 1: Your agency quotes a wage below £14.85ph

(after April 1st 2024)

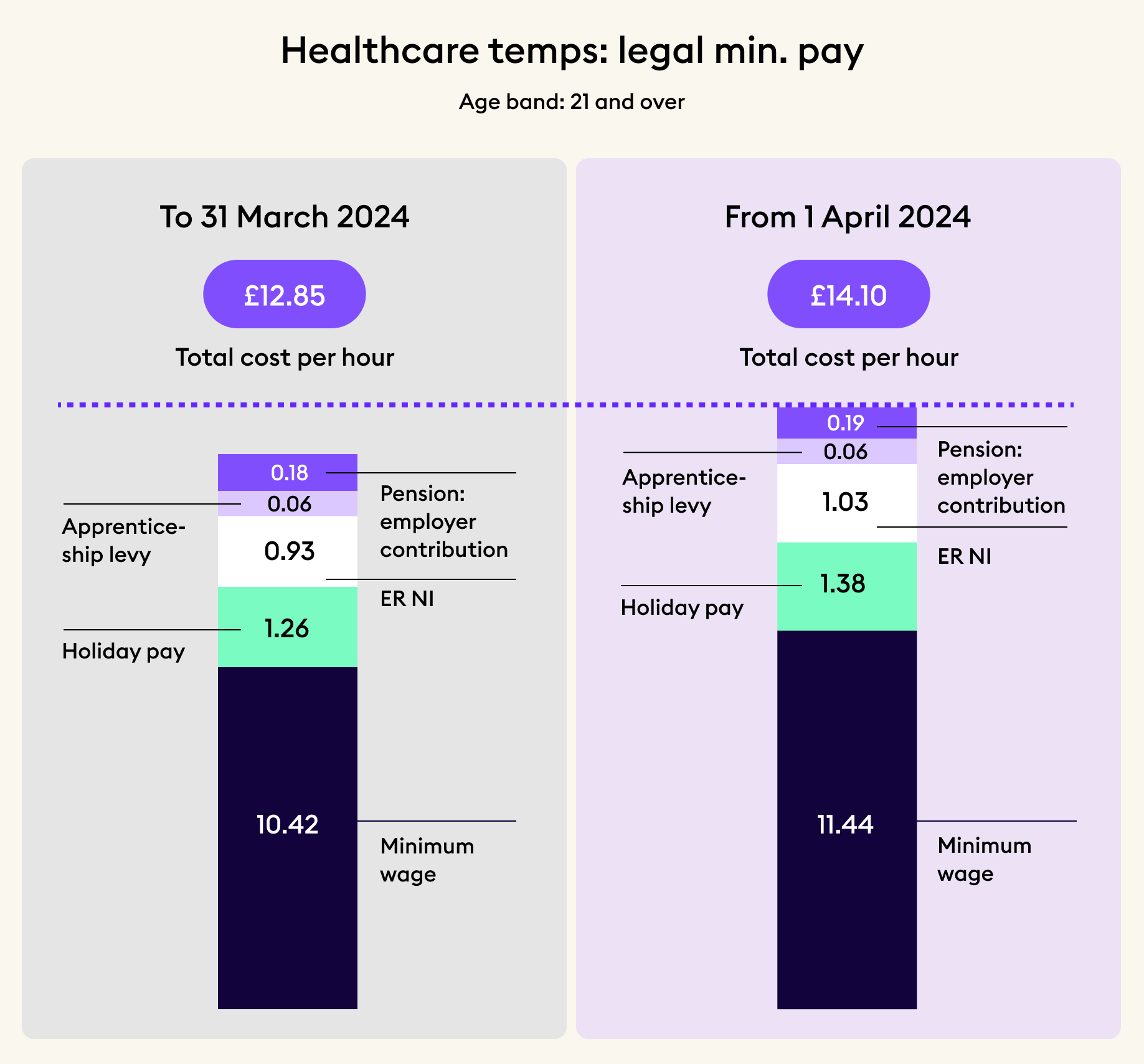

With the turn of the calendar to April 1st, the legal landscape for minimum wage in healthcare shifts significantly.

The legal minimum wage for someone working shifts in your healthcare service is set to rise from £10.42 to £11.44 per hour.

With other on-costs included (NI, pension, holiday pay and apprenticeship levy), this means the total minimum cost of employment is raising from £12.85 per hour to £14.10 per hour (£14.79 in Scotland*).

This isn’t just a number; it’s a baseline for ensuring that the care provided is legal, ethical, and of high quality.

If an agency offers you a rate lower than £14 per hour, it’s a glaring signal that they might not be operating within the bounds of the law.

It begs the question: Is this the type of agency you’d trust with the care of your most vulnerable?

*The minimum pay rate is increasing to at least £12 an hour under a new pledge made by the First Minister, which means the cost to employ someone on minimum wage goes from £12.85 to £14.79. More on this here.

Breaking down the minimum wage

The minimum wage isn’t just a figure plucked from the air; it’s calculated to cover the living costs of the worker, including the components mentioned above.

Here’s a glimpse into how this can break down, ensuring you’re covering all bases for a fair and legal employment package:

Just to note, the minimum wage and holiday pay referenced above are fixed, while other numbers can vary a little but are a fair approximation.

What should go into staff wages

Staff wages aren’t just about the number you see on the payslip.

They encompass several critical components that ensure your staff are supported, valued, and legally covered.

Here’s a rundown of what should be included:

– National insurance (NI): A fundamental part of the employment package, contributing to the wider social security and state benefits system.

– Holiday pay: Everyone needs a break. Including holiday pay ensures staff are compensated for their time off, contributing to their well-being and job satisfaction.

– Pension contributions: Looking after your staff’s future is just as important as their present. Pension contributions are a must for a forward-thinking, responsible employer.

– At least minimum wage: Given the often flexible and less stable nature of agency work, wages typically need to be competitive. This means they should not only meet the minimum legal requirement but ideally exceed it to attract and retain talent.

Beyond the basics: Additional employment costs

Running an agency (or any business, including a care home) involves more than just paying wages.

There are many other costs that contribute to the operation and quality of an agency’s service, including:

– Training: Keeping staff skills sharp and up to date.

– Uniforms: Ensuring your team looks professional and is easily identifiable.

– Payroll management: The administrative side of paying your staff correctly and on time.

– Background checks: Essential for maintaining high standards of safety and care.

– Revalidation Support: Helping staff maintain their professional registration and compliance.

– Head office infrastructure: The behind-the-scenes costs that keep the agency running smoothly, all of which have been impacted by inflation.

The Florence way

We understand the intricacies of staffing in the healthcare sector.

While we allow you to control your rates, we make sure rates can’t be set below the minimum wage.

This means your payment to Florence staff isn’t just an hourly rate; it includes National Insurance, holiday pay, pension contributions, and a commission to Florence.

This transparent, ethical approach makes sure everyone is treated fairly and care provided through Florence meets the highest standards of legality and quality.

In essence, when you choose to work with Florence, you’re not just filling shifts; you’re investing in a system that respects and values the workforce.

This is the heart of providing exceptional care – ensuring those who deliver it are supported, respected, and compensated fairly.

Red flag 2: Your agency applies the wrong VAT to different staff roles

Understanding the nuances of VAT application within agency staffing is crucial, especially when it’s about the care for our elderly.

Some agencies may not add VAT to their worker rates, which might make their costs look more attractive.

However, there are specific situations where VAT should be applied, and if it’s not, it raises a serious question: where else is your agency falling short if they’re cutting corners in areas that really matter, like taxes?

When we hand over the care of our loved ones to an agency, trust is paramount.

If there’s a hint that an agency is sidestepping tax obligations, it’s natural to wonder about their integrity elsewhere.

Are they as diligent with staff background checks and training as they should be?

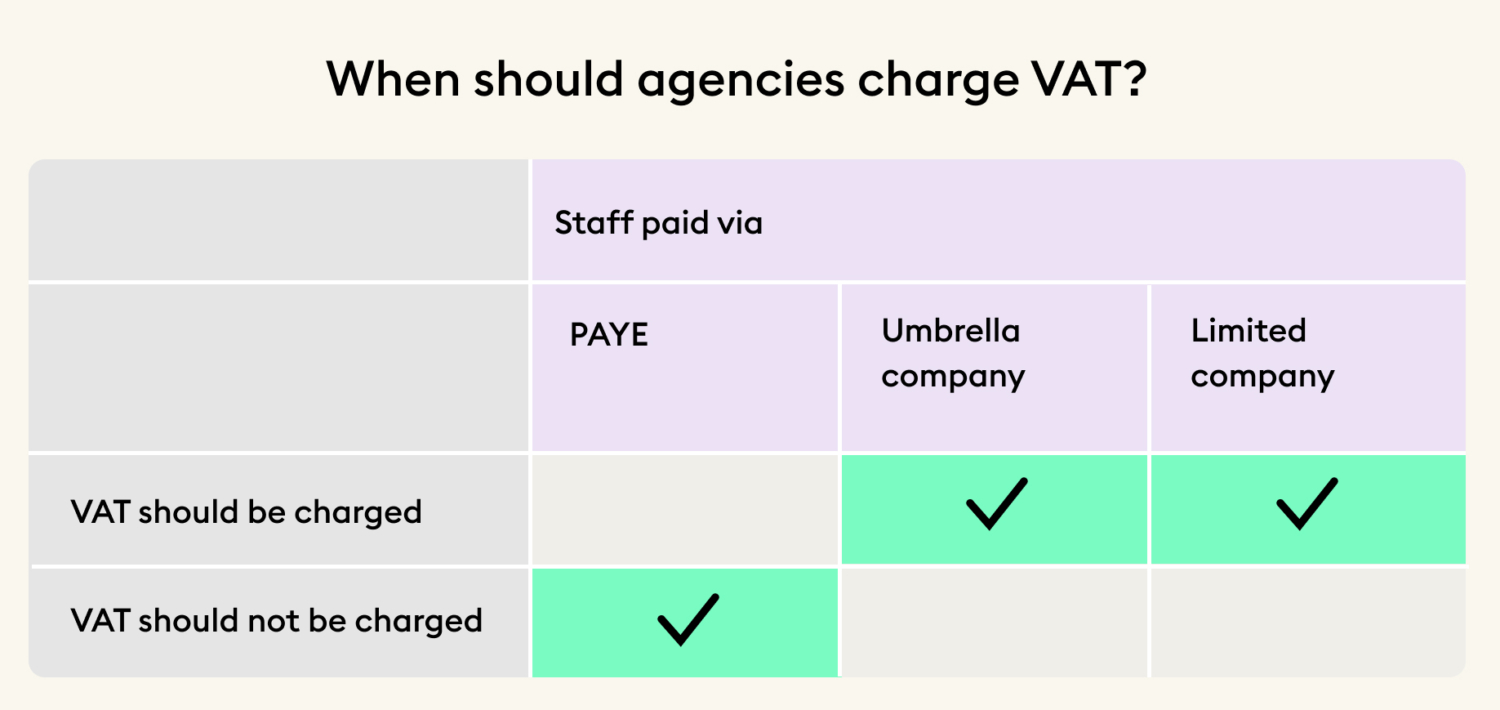

When can agencies legitimately *not* charge VAT?

Agencies fall within the current allowed VAT concession (ie, not needing to charge VAT) when their nurses and care assistants are employed directly by the agency and are paid via PAYE.

Staff also need to be working in a role as defined by HMRC’s nursing concession.

When *should* agencies be charging VAT?

If an agency acts more as a middleman – not directly employing staff but paying them via an umbrella company or through staff’s own limited companies – VAT should indeed be charged.

HMRC specifically says agencies using umbrella companies are not part of the VAT concession (in point 6.6 here), so they should charge VAT.

How do I find out if my agency is illegally not charging VAT?

You can start by inspecting your invoices for VAT charges.

Then, ask your agency how staff are paid. This will tell you whether VAT should be part of their charges.

Regrettably, some agencies dodging these rules may try to evade consequences by shutting down and re-emerging under a new name. But that’s not the path we choose.

The Florence way

At Florence, we value transparency and legality.

All our temporary staff are paid via PAYE, making them direct employees of Florence.

This means we are fully compliant and do not need to charge you VAT (in most cases) – not because we’re cutting corners, but because we’re following the rules to the letter.

(Note that if your care service falls outside of the current allowed VAT concession for healthcare staff referenced above, then we will charge VAT).

Let’s delve further into how your agency’s staff payment practices can indicate other shady issues…

Red flag 3: Your agency doesn’t pay staff via PAYE

When it comes to paying care staff, the method chosen by an agency is more than just an administrative decision; it’s indicative of their commitment to legal and ethical practices.

Agencies that bypass PAYE (Pay As You Earn) might be leaving the door ajar to potential tax avoidance schemes.

It’s essential to ask yourself if you’re comfortable working with an agency that may encourage or turn a blind eye to such practices.

Here’s a closer look at the three common payment methods used by agencies and the associated risks or implications each one holds when it comes to tax adherence.

Which one does your agency use?

1. Payment via an umbrella company

What it is: A company that acts as the go-between the agency and the staff, managing payments due to workers. Many umbrellas operate legitimately, but some do not.

Implications:

– Staff wages are subject to a fee deducted by the umbrella company for managing payments.

– If managed properly, the umbrella company ensures all tax and NI contributions are made, but this also means less take-home pay for staff due to the service fee.

– Some umbrella companies claim to allow staff to retain up to 90% of their earnings, suggesting that they might not be making all necessary deductions, which could lead to tax avoidance.

2. Payment to the staff member’s own limited company

What it is: Staff members receive gross payments into their personal limited company accounts.

Implications:

– It’s up to the individual to manage their taxes and National Insurance contributions.

– This method offers more control over personal finances and the opportunity to be tax-efficient, but it also increases the risk of error or intentional underpayment of taxes. There are almost no cases where it would be in staff members’ best interests to do this.

– Responsibility to pay back any tax shortfall would fall on your care organisation, rather than on the staff member (or their agency). This is because of recent IR35 tax law changes (see more here).

3. Payment via PAYE

What it is: A system where the agency deducts income tax and National Insurance contributions directly from the earnings before the staff member receives pay.

Implications:

– Offers less financial flexibility compared to payments to a limited company.

– Makes sure that all the correct tax payments are made upfront, which is simpler for staff and avoids any potential for tax avoidance.

Red flag 4: Your agency has no zero tolerance policy towards modern slavery

In today’s conscientious world, a modern slavery statement is not just a legal formality; it’s a testament to an agency’s ethical stance.

If your agency lacks one, it raises serious questions.

Check their website to see it. It should be prominent.

In the healthcare staffing sector, the absence of such a statement is particularly concerning given the heightened risk of modern slavery due to urgent staffing demands and high-volume recruitment, often from abroad where awareness of UK working rights may be limited.

The lack of a modern slavery statement may indicate an agency’s indifference towards the fair treatment and protection of its staff.

This is not just about compliance, it’s about ensuring dignity and respect for those who work tirelessly to care for others.

Recent news has shone a light on the disturbing 606% rise in modern slavery cases within the care sector from 2021 to 2022, a stark reminder of the importance of vigilance in this area (source: Unseen UK Care Sector Report 2023).

The Florence way

Florence has a zero tolerance policy to modern slavery.

We are steadfast in our commitment to combat modern slavery. Our approach is detailed in our modern slavery statement, reflecting our unwavering dedication to ethical practices.

Professional support and incident management

We offer robust professional support and incident management procedures, designed to safeguard our staff comprehensively. You can learn more about how we protect our staff on our Professional Support page.

Here we outline our commitment to:

– Providing a supportive work environment

– Give transparent communication channels for any concerns

– Conduct thorough background checks and fair recruitment practices

– Offer continuous training to promote awareness and prevention

Fair pay

As previously mentioned, Florence adheres to fair pay practices, ensuring our staff are rewarded appropriately for their invaluable work. This commitment to fair pay is a crucial element in preventing exploitation and upholding the values we stand for.

Red flag 5: Your agency doesn’t invest in checks and training

Value for money is crucial, but not at the expense of safety and compliance.

Cutting costs on essential checks and training is a false economy that can put vulnerable individuals at serious risk.

The absence of rigorous background checks such as the Disclosure and Barring Service (DBS), Access NI or PVG, or the verification of qualifications and training can lead to dire consequences.

It’s a gamble no one should be willing to take with healthcare provision.

How can you be certain that your agency isn’t overlooking these critical steps? Query them.

A reputable agency should be transparent and forthcoming about their vetting processes, offering you peace of mind with a comprehensive overview of their procedures.

The Florence way

We invest in training

At Florence, we believe in empowering our staff with knowledge and skills. That’s why we offer mandatory training through Florence Academy at no cost to our staff.

Our commitment to ongoing education ensures that every member of our team is not only compliant but also up-to-date with the latest best practices in healthcare.

Thorough background checks

Before any staff member can represent Florence, they undergo a thorough interview process. But we don’t stop there. We conduct the highest level of background checks and meticulously verify every training certificate. This rigorous approach to vetting is integral to our mission of providing the utmost quality of care.

In-person interviews

We also insist on meeting our staff in interviews run by our experienced governance team. This step is crucial – it allows us to get to know the individuals who will be delivering care and to assess their suitability beyond what’s on paper. Our interviews are an essential component of our comprehensive vetting process.

We’ve popped some frequently asked questions below to help you find your way around care costs. Dive in for some quick insights.

1. Why do your rates seem higher than some other agencies?

Our rates reflect our commitment to legal, ethical, and high-quality care. Unlike some agencies that undercut legal minimum wages, we ensure our staff are paid fairly. This isn’t just about meeting legal standards; it’s about respect, dignity, and quality care for everyone involved.

2. What should I expect to be included in staff wages?

Staff wages should cover more than just the hourly rate. They include National Insurance contributions, holiday pay, pension contributions, and at least the minimum wage. These components ensure your staff are supported and valued, both now and in the future.

3. What are the red flags indicating an agency might be paying illegal wages?

– Rates below £14.85 minimum wage: Offering rates lower than £14.85 per hour post-April 1st signals non-compliance with legal standards.

– Incorrect VAT application: Failing to apply VAT correctly can indicate tax avoidance.

– Non-PAYE payments: Agencies not using PAYE might be avoiding taxes, impacting staff welfare.

– Lack of a modern slavery statement: Shows a disregard for the ethical treatment and protection of staff.

4. How does Florence ensure compliance and fair treatment?

Florence uses a transparent approach, ensuring rates meet legal minimums and cover all necessary contributions. We only employ staff through PAYE, ensuring all tax obligations are met. Our commitment to ethical practices is reflected in our modern slavery statement and professional support procedures.

5. Can agencies legally not charge VAT on some staff roles?

Yes, agencies are exempt from charging VAT on the provision of nurses and healthcare assistants when they are employed directly by the agency and paid through PAYE. However, if an agency uses an umbrella company or staff work through their own limited companies, VAT should be charged.

6. What can I do if I suspect my agency is paying illegal wages?

If you suspect illegal practices, start by reviewing your invoices and asking about payment practices for staff. If inconsistencies arise, consider raising your concerns with the agency or seeking advice from legal experts or industry regulators.

7. What impact does paying fair wages have on care quality?

Fair wages ensure that staff are motivated, respected, and valued, leading to higher quality care. When staff feel secure and appreciated, they are more likely to perform their duties with compassion and diligence, ultimately benefiting those they care for.

Navigating the red flags

Navigating the maze of healthcare staffing can be challenging, but being aware of these red flags can guide you to make informed decisions.

The implications of choosing an agency that cuts corners are significant, not just in terms of compliance and legalities, but more importantly, in the quality of care provided to those who need it most.

At Florence, we’re not just another staffing agency; we are your partners in providing exemplary care.

We understand that trust is built on transparency, integrity, and accountability. That’s why we’ve laid out the ‘Florence Way’ – a commitment to doing right by our staff and your service users.

Choosing Florence means choosing an agency that doesn’t just fill shifts but upholds the dignity and safety of everyone involved.

As you move forward in selecting an agency, keep these red flags in mind and choose a partner who has none.

Curious about Florence? Book a demo to learn how we can help you find, retain and train an experienced team to help you deliver outstanding care.

You might also be interested in:

– Florence vs agencies: 10 reasons to choose Florence